Pickstock#

Importing Modules#

The gamspy Python package is loaded in order to access GAMSPy syntax.

[1]:

from gamspy import Container, Set, Alias, Parameter, Variable, Equation, Model, Sum, Sense, Card, Options

Loading the price data#

The price data is provided from a CSV file located on the web. The Python package pandas is used to load the data.

[2]:

import pandas as pd

url = (

"https://github.com/daveh19/pydataberlin2017/raw/master/notebooks/dowjones2016.csv"

)

price_data = pd.read_csv(url)

[3]:

m = Container()

date = Set(m, "date", description="trading date")

symbol = Set(m, "symbol", description="stock symbol")

price = Parameter(

m,

"price",

[date, symbol],

domain_forwarding=True,

records=price_data,

description="price of stock on date",

)

d = Alias(m, "d", date)

s = Alias(m, "s", symbol)

[4]:

price.records.head()

[4]:

| date | symbol | value | |

|---|---|---|---|

| 0 | 2016-01-04 | AAPL | 105.349998 |

| 1 | 2016-01-04 | AXP | 67.589996 |

| 2 | 2016-01-04 | BA | 140.500000 |

| 3 | 2016-01-04 | CAT | 67.989998 |

| 4 | 2016-01-04 | CSCO | 26.410000 |

The mean price per stock is calculated in GAMS.

[5]:

avgprice = Parameter(m, "avgprice", symbol, description="average price of stock")

avgprice[s] = Sum(d, price[d, s]) / Card(d)

avgprice.records.head()

[5]:

| symbol | value | |

|---|---|---|

| 0 | AAPL | 104.604008 |

| 1 | AXP | 63.793333 |

| 2 | BA | 133.111508 |

| 3 | CAT | 78.698016 |

| 4 | CSCO | 28.789683 |

The averages can be used in order to calculate weights.

[6]:

weight = Parameter(m, "weight", symbol, description="weight of stock")

weight[symbol] = avgprice[symbol] / Sum(s, avgprice[s])

weight.records.head()

[6]:

| symbol | value | |

|---|---|---|

| 0 | AAPL | 0.039960 |

| 1 | AXP | 0.024370 |

| 2 | BA | 0.050850 |

| 3 | CAT | 0.030063 |

| 4 | CSCO | 0.010998 |

Compute the contributions using weight and price

[7]:

contribution = Parameter(m, "contribution", [date, symbol])

contribution[d, s] = weight[s] * price[d, s]

contribution.records.head()

[7]:

| date | symbol | value | |

|---|---|---|---|

| 0 | 2016-01-04 | AAPL | 4.209752 |

| 1 | 2016-01-04 | AXP | 1.647143 |

| 2 | 2016-01-04 | BA | 7.144396 |

| 3 | 2016-01-04 | CAT | 2.044007 |

| 4 | 2016-01-04 | CSCO | 0.290455 |

Compute index values

[8]:

index = Parameter(m, "index", date, description="Dow Jones index")

index[d] = Sum(s, contribution[d, s])

index.records.head()

[8]:

| date | value | |

|---|---|---|

| 0 | 2016-01-04 | 100.572929 |

| 1 | 2016-01-05 | 100.511422 |

| 2 | 2016-01-06 | 99.014207 |

| 3 | 2016-01-07 | 96.606033 |

| 4 | 2016-01-08 | 95.685461 |

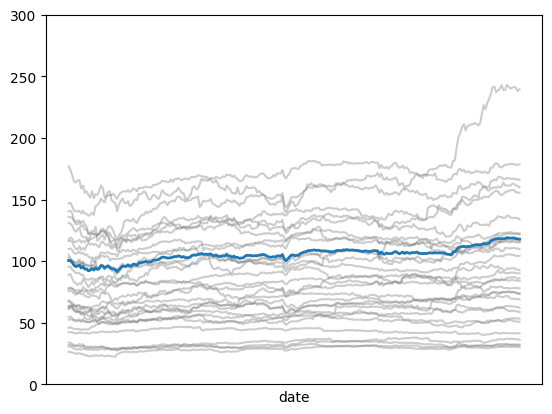

Create a plot showing the symbol and index values over time

[9]:

import matplotlib

import matplotlib.pyplot as plt

fig, ax = plt.subplots()

price.records.groupby("symbol", observed=True).plot(

x="date",

y="value",

ax=ax,

alpha=0.4,

color="grey",

legend=False,

ylim=(0, 300),

xticks=[],

)

index.records.plot(x="date", y="value", ax=ax, linewidth=2, legend=False)

[9]:

<Axes: xlabel='date'>

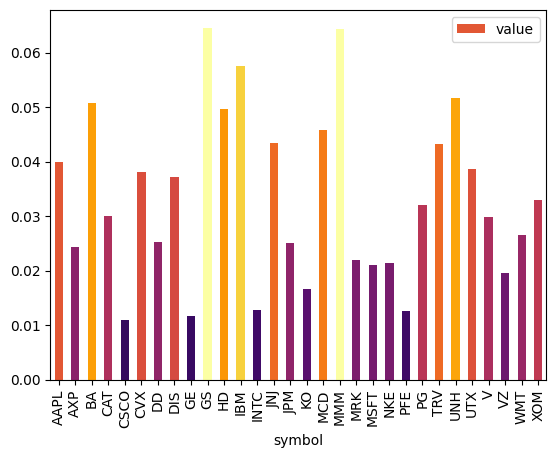

[10]:

sMap = matplotlib.cm.ScalarMappable(

norm=matplotlib.colors.Normalize(0, weight.records["value"].max()), cmap="inferno"

)

color = [sMap.to_rgba(x) for x in weight.records["value"]]

weight.records.plot.bar(x="symbol", y="value", color=color)

[10]:

<Axes: xlabel='symbol'>

Define dynamic set ds and scalar maxstock.

[11]:

trainingdays = Parameter(m, "trainingdays", records=100)

maxstock = Parameter(m, "maxstock", records=3)

ds = Set(m, "ds", date, description="selected dates")

ds.setRecords(date.records["uni"][:100])

Declaration of the variables and equations used to formulate the optimization model

[12]:

p = Variable(m, "p", "binary", symbol, description="is stock included?")

w = Variable(m, "w", "positive", symbol, description="what part of the portfolio")

slpos = Variable(m, "slpos", "positive", date, description="positive slack")

slneg = Variable(m, "slneg", "positive", date, description="negative slack")

Defining the actual model#

We know come to the decision problem, where we want to pick a small subset of the stocks together with some weights, such that this portfolio has a similar behavior to our overall Dow Jones index.

The model is based on a linear regression over the time series, but we minimize the loss using the L1-norm (absolute value), and allow only a fixed number of weights to take nonzero variable.

\begin{align} \text{minimize} \qquad & \text{obj}:= \sum_{ds} \text{slpos}_{ds} + \text{slneg}_{ds} \\ \text{subject to} \qquad & \sum_{s} \text{price}_{ds, s} \cdot w_{s} = \text{index}_{ds} + \text{slpos}_{ds} - \text{slneg}_{ds} & (\forall{ds}) \\ & w_{s} \leq p_{s} & (\forall{s}) \\ & \sum_{s}{p_{s}} \leq \text{maxstock} \\ & w_{s}\geq 0, \qquad p_{s}\in \{0,1\} & (\forall s) \\ & \text{slpos}_{d}\geq 0, \qquad \text{slneg}_{d}\geq 0 & (\forall d) \end{align}

[13]:

fit = Equation(m, name="deffit", domain=[ds], description="fit to Dow Jones indeex")

fit[ds] = Sum(s, price[ds, s] * w[s]) == index[ds] + slpos[ds] - slneg[ds]

pick = Equation(

m, name="defpick", domain=[s], description="can only use stok if picked"

)

pick[s] = w[s] <= p[s]

numstock = Equation(m, name="defnumstock", description="few stocks allowed")

numstock[...] = Sum(s, p[s]) <= maxstock

Objective

[14]:

obj = Sum(ds, slpos[ds] + slneg[ds])

Model

[15]:

pickstock = Model(

container=m,

name="pickstock",

equations=m.getEquations(),

problem="MIP",

sense=Sense.MIN,

objective=obj,

)

Specify ‘maxstock’ and ‘trainingdays’ and solve the model.

[16]:

ds.setRecords(date.records["uni"][:100])

maxstock.setRecords(3)

Solve

[17]:

pickstock.solve(options=Options(relative_optimality_gap=0.01, time_limit=6))

[17]:

| Solver Status | Model Status | Objective | Num of Equations | Num of Variables | Model Type | Solver | Solver Time | |

|---|---|---|---|---|---|---|---|---|

| 0 | Normal | Integer | 45.5725938967286 | 132 | 261 | MIP | CPLEX | 0.142 |

Generate reporting parameters

[18]:

fund = Parameter(m, "fund", [date], description="Index fund report parameter")

fund[d] = Sum(s, price[d, s] * w.l[s])

error = Parameter(m, "error", [date], description="Absolute error")

error[d] = index[d] - fund[d]

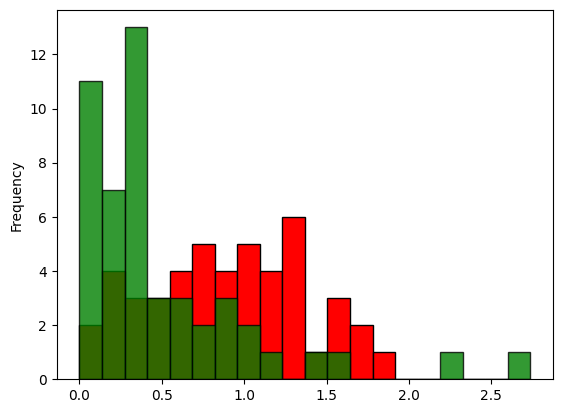

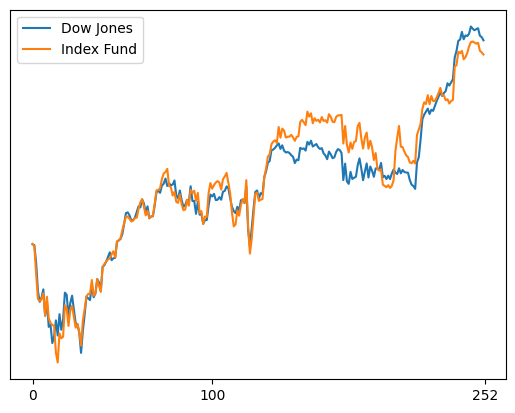

Plotting of the results

[19]:

fig, ax = plt.subplots()

trainingDays = int(trainingdays.records.iloc[0].to_list()[0])

index.records.plot(

y="value",

ax=ax,

xticks=[0, trainingDays, len(date.records)],

yticks=[],

label="Dow Jones",

)

fund.records.plot(

y="value",

ax=ax,

xticks=[0, trainingDays, len(date.records)],

yticks=[],

label="Index Fund",

)

[19]:

<Axes: >

[20]:

maxError = error.records["value"].max()

fig, ax = plt.subplots(edgecolor="black")

error.records["value"][trainingDays:].plot.hist(

x="date",

y="value",

ax=ax,

bins=20,

range=(0, maxError),

label="later",

color="red",

edgecolor="black",

)

error.records["value"][:trainingDays].plot.hist(

x="date",

y="value",

ax=ax,

bins=20,

range=(0, maxError),

label="training",

color="green",

alpha=0.8,

edgecolor="black",

)

[20]:

<Axes: ylabel='Frequency'>